Renters Insurance in and around Louisville

Your renters insurance search is over, Louisville

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Think about all the stuff you own, from your smartphone to clothing to video games to golf clubs. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Your renters insurance search is over, Louisville

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

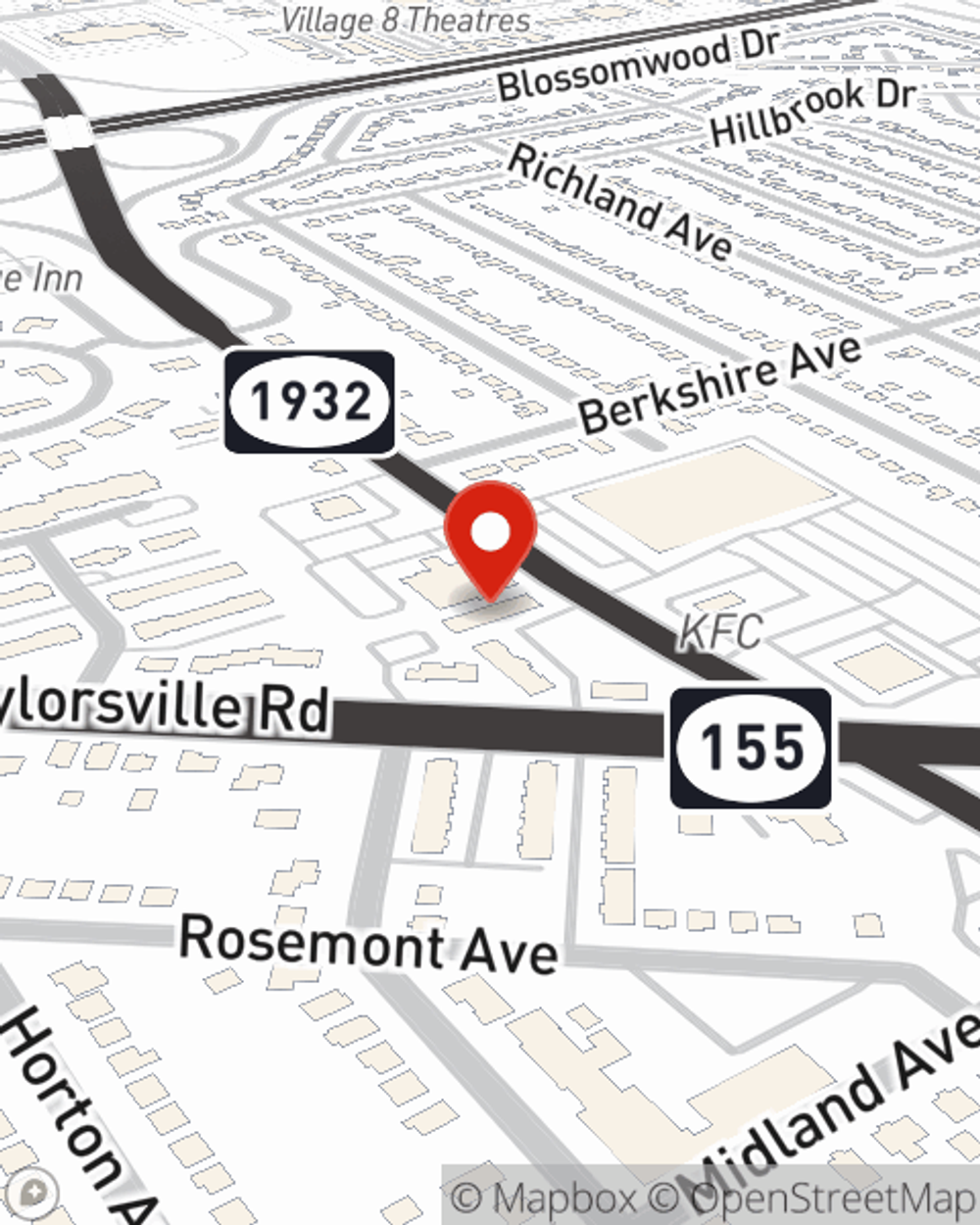

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Mike Kenney can help you identify the right coverage for when the unpredictable, like a water leak or an accident, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Louisville renters, are you ready to discover the benefits of a State Farm renters policy? Get in touch with State Farm Agent Mike Kenney today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Mike at (502) 473-1172 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Mike Kenney

State Farm® Insurance AgentSimple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.